When it comes to planning for retirement, it’s easy to overlook some of the risks involved. If you don’t consider how your retirement income can be impacted by investment risk, inflation risk, catastrophic illness, long-term care, and taxes, you may not be able to enjoy the retirement you envision.

In this article, we’ll look at what’s at stake. And remember—financial advisors are trained to help you plan for these risks.

Investment Risk

All investing carries some risk, but not every investment carries the same risk. Sound retirement planning involves understanding these risks and how they can influence your available income in retirement.

Investment or market risk refers to the chance that your investments will lose value, which can shrink your nest egg. For instance, if you’re invested in a stock and the stock price falls, the value of your investment shrinks. Withdrawing money from an investment account during a downturn can lock in losses and affect how long your money lasts.

While most retirement planning accounts for market ups and downs, timing matters. If you make constant withdrawals from investment accounts during a market downturn, it may deplete your savings far sooner than planned.

Reinvestment risk is the risk that interest rates fall, meaning when you go to reinvest any money you make on a fixed income investment, such as a bond, the new investment is likely to pay a lower yield than the original.

To generate a similar return, you may need to take on more risk. There are multiple ways to address this type of risk, including total return funds and diversification.

Interest rate risk occurs when interest rates rise, which can impact a wide array of investments. In the bond market, for instance, new bonds issued with higher rates mean that investors won’t want to buy older bonds that pay a lower yield, driving the market price of those bonds lower.

This won’t matter if you own an individual bond and plan to hold it to maturity. However, if you hope to sell that bond at any point, or are invested in bond funds, these price fluctuations matter. Rising rates can also affect the value of stocks. Companies may end up paying more interest on any existing debt, or may borrow less to fund new growth, both of which can impact profits and share prices.

Inflation Risk

Inflation is the risk that a dollar will buy less in the future than it does today. In general, this is due to the rising cost of goods and services. If inflation runs at its historical long-term average of about 3%, the purchasing power of a given sum of money will be cut in half in 23 years. If it jumps to 4%, the purchasing power is cut in half in 18 years.

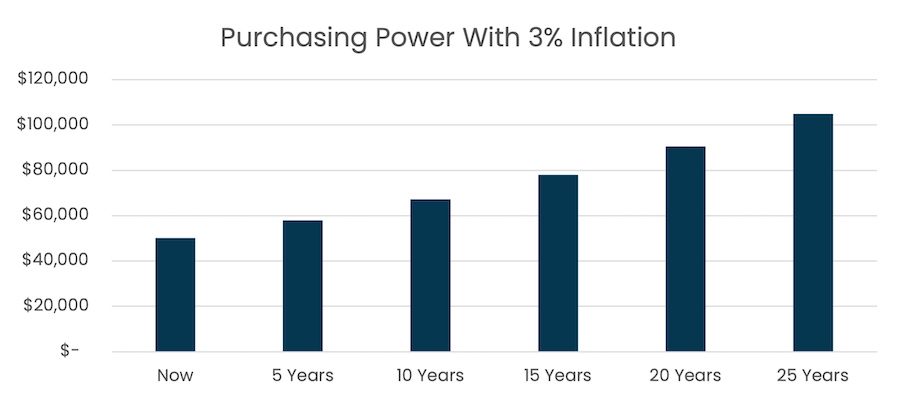

A simple example illustrates the impact of inflation on retirement income. Assuming a consistent annual inflation rate of 3%, and excluding taxes and investment returns in general, if $50,000 satisfies your retirement income needs this year, you’ll need $51,500 of income next year to meet the same income needs. In 10 years, you’ll need about $67,195 to equal the purchasing power of $50,000 this year.

Therefore, to outpace inflation, you should try to have some strategy in place that allows your income stream to grow throughout retirement.

The following hypothetical example is for illustrative purposes only and assumes a 3% annual rate of inflation without considering fees, expenses, and taxes. It does not reflect the performance of any particular investment.

Purchasing Power of $50,000 at 3% Inflation

Long-Term Care Expenses

Long-term care may be needed if physical or mental disabilities impair your ability to perform basic tasks. As life expectancies increase, so does the potential need for long-term care.

Paying for long-term care can have a significant impact on retirement income and savings, especially for the healthy spouse. While not everyone needs long-term care during their lives, ignoring the possibility of such care and failing to plan for it can leave you or your spouse with little or no income or savings if such care is needed.

Even if you decide to buy long-term care insurance, don’t forget to factor the premium cost into your retirement income needs.

A complete statement of coverage, including exclusions, exceptions, and limitations, is found only in the long-term care policy. It should be noted that carriers have the discretion to raise their rates and remove their products from the marketplace.

The Costs of Catastrophic Care

As the number of employers providing retirement health care benefits dwindles and the cost of medical care continues to spiral upward, planning for catastrophic health care costs in retirement is becoming more important.

If you recently retired from a job that provided health insurance, you may not fully appreciate how much health care really costs.

Despite the availability of Medicare coverage, you’ll likely have to pay for additional health-related expenses out of pocket. You may have to pay the rising premium costs of Medicare optional Part B coverage (which helps pay for outpatient services) and/or Part D prescription drug coverage.

You may also want to buy supplemental Medigap insurance, which is used to pay Medicare deductibles and co-payments and to provide protection against catastrophic expenses that either exceed Medicare benefits or are not covered by Medicare at all. Otherwise, you may need to cover Medicare deductibles, co-payments, and other costs out of pocket.

Taxes

Taxes can eat into your income, significantly reducing the amount you have available to spend in retirement. For one thing, it’s impossible to know what income tax brackets will look like in the future. But that doesn’t mean it’s impossible to plan for tax-related risks in retirement.

If you plan on using traditional (pretax) retirement accounts for income in retirement, the money is generally taxed as ordinary income. When it comes to general investment accounts, some income (like interest payments) is taxed as ordinary income, while other income—like any gains on investments you’ve owned for more than a year—qualify as long-term capital gains instead.

Some specific investments, like certain municipal bonds,* generate income that is exempt from federal income tax altogether. You should understand how the income generated by your investments is taxed so that you can factor the tax into your overall projection.

Understanding the tax consequences of these investments is important when making retirement income projections.

Have You Planned for These Factors?

When planning for your retirement, consider these common factors that can affect your income and savings. While many of these same issues can affect your income during your working years, you may not notice their influence because you’re not depending on your savings as a major source of income. However, investment risk, inflation, taxes, and health-related expenses can greatly affect your retirement income.

At Bogart Wealth, our advisors build retirement plans that take the risks covered in this article into account. We monitor these risks on an ongoing basis—looking at how events ranging from rate hikes to economic uncertainty might impact your plan for retirement. If you’re curious what the process looks like, or want to discuss how these risks impact your current retirement plan, contact us today.

Please remember that due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Bogart Wealth. Bogart Wealth is neither a law firm nor a certified public accounting firm and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Bogart Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was prepared by Broadridge Investor Communication Solutions, Inc.